A commercial retailing bank in Nigeria, Guaranty Trust Bank (GTB), has been alleged of unsolicited account openings for individuals and data breaches.

One of the victims, who pleaded anonymity, decried that the bank’s activities revealed “corrupt practices which I believe is against the Central Bank of Nigeria (CBN)’s operational guidelines.”

Explaining her concerns, the affected fellows said: “I started getting emails from GTB, informing me about my supposed newly opened savings account with them, with an instruction to pay into the account account to activate it. Initially, I considered it a spam and an attempt by fraudsters to feed on me. So, I deleted the messages as soon as I got them.

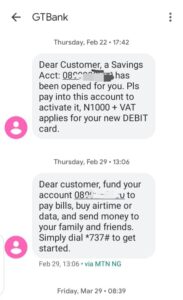

“Later, they started sending text messages to me, instructing me to pay into the act.”

One of the text messages sent to her, which was sited by REPORTERS AT LARGE, reads, “Dear customer, a savings account: 08xxxxxx00 has been opened for you. Please pay into this account to activate it, N1,000 plus VAT applies for your new debit card.”

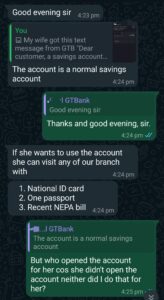

She further explained that she later showed the message to her husband, who banks with GTB. “Then, my husband had WhatsApp chat with his account officer to confirm the authenticity of the message. His account officer confirmed the account number and names.

“Then, my husband account officer sent a message to him. Thus,”The account is a normal savings account. If she wants to use the account, she can visit any of our branches with 1. National ID card, 2. One passport, 3. Recent NEPA bill.”

She added that her husband querried, saying, “But who opened the account for her cos she didn’t open the account, neither did I do that for her? Does GTB now automatically open an account for customers?. The account officer didn’t respond.”

The development, according to the victim, “is a violation of customers’ privacy and data protection regulations, and potential identity theft and financial fraud. It also shows a lack of transparency and accountability in account opening processes in GTB.”

The victim charged the Central Bank of Nigeria (CBN) and the National Assembly “to investigate the fraudulent practices and address it accordingly.

“I know that I am not the only victim. I cannot just imagine the level of data breach and fraudulent activities involved in the bank,” she lamented.

REPORTERS AT LARGE’s further investivations revealed that there are many other Nigerians with the same experiences. But those who confirmed the experience did not show our correspondence any proves.