The senior pastor of Kingsway International Christian Centre (KICC), Matthew Ashimolowo, has cautioned Nigerians against investing in bank shares, coins, and e-coins, instead advising them to invest in real estate. He recounted how he lost about N200 million in Nigerian bank shares.

This came as many of the Nigerian commercial banks, including Guaranty Trust Bank and Zenith Bank, rolled out shares as part of plans to surpass the new capital threshold introduced by the Central Bank of Nigeria.

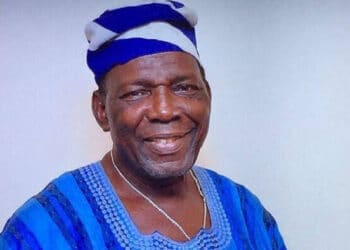

The 72-year-old clergyman, during an interview on the Key to Keys (KK) podcast posted on YouTube on Monday, revealed he invested millions in Nigerian banks, resulting in substantial losses.

He said: “I lost about N200 million in shares of Nigerian banks. If I had used that money to buy land, I wouldn’t need to cut the grass. By now, it would have yielded more. I’m not talking about wonder (new) banks, but the ones that have been around till today. Every time their shares go down, their Managing Directors (MDs) and founders rise. How come? In Nigeria’s shares space, I have suffered. I noticed that the banks are now calling on people to buy shares. But how many will you buy?

“Hear my story. I’ll mention banks, and there’s nothing they can do to me because it’s not a lie. I bought N36 million shares in First Bank at N36 per share. It fell to N12, and I lost that. I then borrowed N60 million in 2005 or 2006 from Sterling Bank to buy Skye Bank shares, and it fell from N14 to N12.50 kobo, washing away my investment. Sterling Bank showed up in our church with four policemen to collect their money, and I had to scramble to find it within three months.”

Mr Ashimolowo further narrated how the Risk Manager of Skye Bank, who loaned him money, showed up in church to harass him.

Recounting the experience, he said, “The Risk Manager of Skye Bank came with about ten staff to our service as if he wanted to disrupt the church service. The same bank that loaned me money when I was building a house showed up at a church with no connection to my company. I’m mentioning banks so they’ll know I have the right to. I bought GTBank shares (which I have been banking with since 1993) at N18, which fell to N3.60 kobo.

“Imagine if I had used all that money I lost to buy land 20 years ago? At the time, I had N60 million to buy Sky Bank shares—the price of a plot of land on Banana Island. And now, instead of losing my money to shares, that land would have become worth over a billion.”

Investment to consider instead of Bank Shares

Furthermore, the clergyman cautioned Nigerians against investing in bank shares, coins, and e-coins but instead in real estate.

“Real estate is an excellent place to invest. There are two risks: high and low. Low risk is leaving your money in a savings account, and it was washed away by inflation. If your money is in a savings account in Nigeria, it’s rubbish, and the reason is they’ll put 5 per cent or 10 per cent on your money while the inflation is 30 per cent.

Nigeria’s problems

Additionally, the pastor maintained that Nigeria’s overall challenges are a combination of leadership failures and systemic problems.

According to him, Nigeria’s problems are multifaceted.

“In Nigeria, we have two big problems. You might think our only issue is leadership, but it’s both leadership and the system. If we have a good leader flying a plane leaking oil, we’ll still have problems. If you have a perfect plane with a bad pilot, you’ll also have problems. So, we face two issues in Nigeria: the lack of quality leadership and the fact that we’re flying a broken plane.

“Sometimes I feel worried when I look at the people in the Senate and House of Representatives; they’re young men who didn’t experience war, yet they’re beating the drums of war and pouring fuel on Nigeria’s fire. They think they can just run away with their passports, but they don’t realise that many don’t understand that Nigeria is their refuge,” he noted.