The Ekiti State government has begun the implementation of mandatory payment of Property Tax by landlords and landowners in the state as part of the measure to shore up its Internally General Revenues (IGR) base.

The Chairman of the Ekiti State Internal Revenue Service, Mr. Muyiwa Ogunmilade disclosed this in a statement made available to newsmen in Ado Ekiti, on Sunday.

Ogunmilade said the Ekiti State Property Tax Law backed by the State Land Use Charge Law No 3 of 2013, which comprises payment on ground rent, tenement rates and neighbourhood improvement levy, has been neglected for long, saying time has come for it to be put to full use in view of the low revenues from the Federal allocation to the state .

To achieve the policy under the Land Use Charge Law, the Chairman said aggressive enumeration of all buildings and landed property across over 130 towns in the state has commenced for hitch-free implementation of the tax policy.

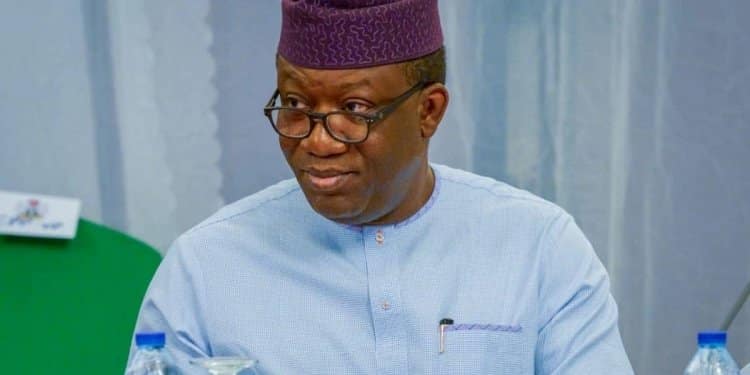

He noted that Governor Kayode Fayemi was uninterested to impose double taxation or obnoxious tax policy on residents, clarifying that the new measure was just an implementation of an existing, but abandoned law.

“The LUC is an annual tax, payable in respect of all real estate property situated in Ekiti State, including ordinary parcels of land and with improvement except those exempted under the Law.

“Owners are expected to pay the LUC for their respective properties, or alternatively the tenants may pay and get reimbursement from the owners of the properties.

“For accurate charges to be arrived at, property identification officers or assessors have begun the process of enumeration of all properties in our state and this will provide proper guide for the government, because you have to pay based on the property owned.

“I appeal to our people to cooperate with the property identification officers in the course of discharging their duties by providing access and accurate information about their property”, he said.

Ogunmilade added that apart from ensuring that the revenue profile of the state is boosted with the law, it would fasttrack the process for the capturing of more citizens in the tax net to discharge their statutory obligations to the government for effective service delivery.

He said boosting of IGR would provide a solid foundation for proper planning and well structured development across all the strata of the state.