The Central Bank of Nigeria (CBN) has again raised the Monetary Policy Rate (MPR), which measures interest rates by 50 basis points, from 26.25% to 26.75% amid soaring inflation and skyrocketing food prices.

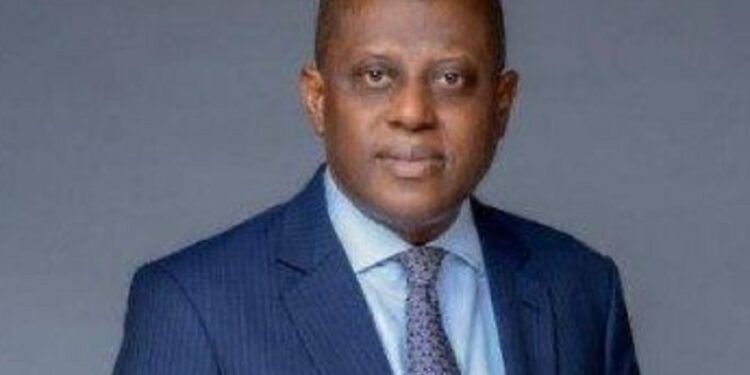

CBN Governor, Olayemi Cardoso, announced this after the apex bank’s 296th Monetary Policy Committee (MPC) meeting in Abuja on Tuesday.

The MPC adjusted the asymmetric corridor around the MPR from +100 to -300 to +500 to -100 basis points.

The MPC also retained the Cash Reserve Ratio (CRR) of deposit money banks at 45% and merchant banks at 14% and retained the Liquidity Ratio at 30%.

Cardoso said the committee was mindful of the effect of rising prices on households and businesses and expressed its resolve to take necessary measures to bring inflation under control.

Despite the June 2024 inflation spike, he stated that we expect prices to moderate in the near term as monetary policy gains more traction and the fiscal authority takes further measures to address food inflation.

The MPC worried that food inflation and rising energy costs continued to undermine price stability.

He announced September 23 and 24 as the next meeting of the MPC.

Nigeria is battling one of its worst economic crises in recent times, with rising living and energy costs, sparked by the twin policies of the government’s removal of petrol subsidy and unification of the foreign exchange winders in May 2023.

The country’s inflation reached an all-time high in June, hitting 34.19%, according to the latest data from the National Bureau of State Statistics (NBS).

Food inflation also rose in June 2024 to 40.87% year-on-year compared to 40.66% recorded in May 2024, 15.62% higher than the 25.25% recorded in June 2023.

The President Bola Tinubu administration, alongside governors in the 36 states, has since rolled out a number of palliative measures, but Nigerians continue to be lamentably hurt by the severe impact of inflation as the prices of food commodities and basic products multiply uncontrollably.