Typical of major issues in our dear country, the proposed Tax Reforms Bills, 2024 transmitted to the two chambers of the National Assembly by President Bola Tinubu in October for necessary legislative inquisition has snowballed into the spectre of muscle flexing, talkbacks, and mudslinging. For weeks, the matter has dominated the media space. Suddenly, many people are “experts” on tax matters. At every forum, not minding the size, it is common to see some people waxing “authoritative” as they marshall arguments for or against the bills. What a country!

Following debates, interactions, and thoughts-sharing on different platforms has revealed the burning desire and passion for national development. However, one disturbing fact is the exhumation of our fault lines: ethnicity, tribal, and regional persuasions in the ongoing needless brouhaha. Also, bandwagoning is easily noticeable, as many commentaries are mere regurgitations of opinions by some “experts.” More worrisome is that many of those pontificating and sermonising are yet to study the Bills.

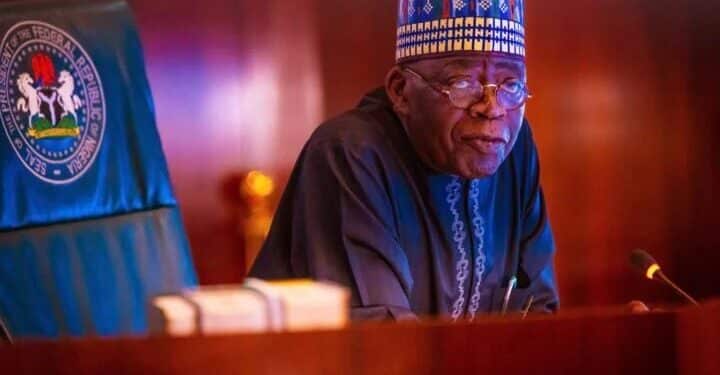

Though one cannot pretend to be an authority on tax matters as a journalist, social activist, humanist, and public policy analyst, the writer has been privileged to read and study the Bills. The Taiwo Oyedele-led Committee deserves some applause, not condemnation, for devoting time, intellect, and capacities to the ideation of each of the four bills. Like or loathe him, President Bola Tinubu should be commended for providing the political will to conceptualise the bills that seek to revolutionise tax generation, attribution, and distribution.

The proposed reforms address several issues that would positively drive economic growth and transformational development on solid foundations. Perhaps it is time for Nigerians (those for and against the bills) to interrogate the document using more informed and refined approaches. It would not be bad if people could dispassionately encore the poser by the Senate Leader, Opeyemi Bamidele. The Ekiti-born politician asked, “Are the Tax Reform Bills truly regressive or antithetical to people’s aspirations, as some state governors (and other leaders) have claimed?”

Contrary to assumptions by some people, the opinions and positions reeled out by the National Economic Council (NEC), chaired by Vice President Kashim Shettima, and the National Assembly do not, in any way, indicate cracks or divisions in the relationship between the legislative and executive arms of government. Instead, it is a plus for governance, as it reveals the resoluteness, doggedness, and commitment various leaders have shown in building a robust economy that can be insulated from external shocks.

The COVID-19 pandemic and global economic meltdown undoubtedly threw up many development challenges, but it also provided opportunities for economic recovery and the deepening of sectoral development. From the issues canvassed in the Bills, veritable templates for reforming the tax system, prioritising economic growth, providing opportunities for business growth, and boosting the economy’s production capacity are top on the plate. Regarding business taxation, the reform aims to improve and encourage investments, competitiveness, innovation, and dynamism. Other benefits include cleaning up complicated tax provisions, eliminating tax penalties on families, ensuring financial security as real earnings and savings are guaranteed, improved employment generation, and quality job offers.

If and when the bill is implemented, policymakers can deploy some major components as strategic tools to improve tax incentives, contain inflation, and support long-term economic planning and development. Each reform is properly articulated to help citizens by creating the federal tax code to prioritise economic growth, creating conditions for improved investments, enhanced living standards, and other benefits. The Tax Reform would create resilience against uncertainty and higher inflation and increase the global competitiveness of Nigerian business enterprises among other countries.

As enunciated in the Bill, reforms on the VAT regime are geared towards establishing a simplified, effective, and efficient system that will provide a grant of full input VAT credit for businesses to reduce the cost of production and ease the strain on cash flows. It will expand the list of essential food items, educational and health care products to be exempted from VAT to protect the lower class; harmonisation of all consumption taxes and adjustment of the revenue sharing formula to favour sub-national units; address the challenges of a diversity of taxes. VAT exemption threshold for small businesses; removal of VAT on the export of service and intellectual property to promote non-oil exports; upward adjustment to the VAT rates on items not exempted to avoid a significant drop in revenue; and the introduction of VAT fiscalization and electronic invoicing are some of the novel innovations.

More importantly, the Tax Reform proposes to launch Nigeria’s First Tax Inspectors Without Borders—Criminal Tax Investigations Program in conjunction with the United Nations Development Programme, (UNDP) and the Organisation for Economic Cooperation and Development. The programme aims to combat tax evasion, curb illicit financial flows, and entrench tax transparency in the country’s fiscal regime. Through this, there would be capacity building for tax crime investigators, strengthening enforcement frameworks for effective dispute resolution, facilitating knowledge sharing between Nigeria’s tax regulatory agencies and its associates worldwide, and deepening linkages for improved service deliveries.

Generally, no proposition is perfect, no matter how ingenious, creative, and imaginative. The Tax Reform Bills cannot be an exception. Rather than subject the proposal to outright condemnation and vilification, Nigerians, particularly the political elites and economic class, are advised to channel their misgivings and fears to the appropriate channels of inquisition—the legislature. It is time politicians eschew negative theatrics and dirty games in matters that bother national development. It is argued that few people who have been serial beneficiaries of the present flawed tax system are behind the growing orchestrated attacks on the proposal. To move Nigeria to her rightful place amongst the comity of nations, every narrow-minded, archaic factor and banal reasoning must be thrown into the abyss and replaced with modern, quality, and dynamic leadership modules.

*Lanre Ogundipe was the former President of Nigeria & African Union of Journalists.