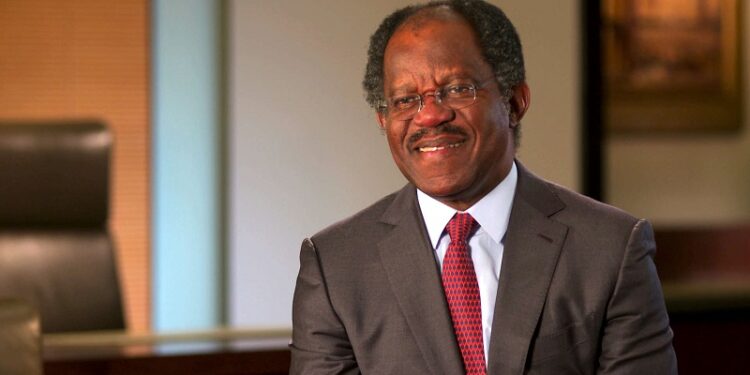

Very few people had heard about Adebayo Ogunlesi before February 2010. The Nigerian-born investment banker and money manager gained worldwide attention when he oversaw the £1.51 billion acquisition of London’s Gatwick Airport from the British Airports Authority.

The chairman and managing partner of Global Infrastructure Partners (GIP), a New York-based independent private equity fund with more than $5.6 billion under management and a primary focus on infrastructure projects, is Adebayo Ogunlesi. Ogunlesi, 58, gained instant notoriety around the world as a result of the purchase and will go down in history as the person who bought London’s second-largest international airport.

Although the purchase of Gatwick Airport may have garnered most of the attention, GIP also owns a 75% share in London City Airport and the UK-based waste management company Biffa Limited.

Over the years, Gatwick has incurred significant losses, and despite all of the British Airport Authority’s (BAA) efforts to turn things around, the decline never stopped. The airport reportedly suffered a pre-tax loss of more than £780 million in the first nine months of 2009, which prompted the British government to actively look for owners. In addition, BAA reportedly lost £225 million on Gatwick after the Competition Commission forced it to sell the airport.

Although Ogunlesi’s acquisition may have given him international recognition and turned him into a sort of overnight private equity rock hero, analysts were eager to see what he would do with the failing airport. Yet Ogunlesi was so confident in the airport’s future that he contributed some of his own money to the purchase. He pledged to significantly enhance the customer experience and turn Gatwick into an international airline of the highest calibre. According to his past performance, he is likely to keep his commitments.

Ogunlesi oversaw the purchase of London City Airport in 2006. Following its takeover, Ogunlesi led several operational upgrades intended to increase capacity and enhance the operating offering and service quality.

The passenger volume at London City Airport increased by 22% during GIP’s first full year of ownership, according to data on the company’s website.

Formidable footprints of Adebayo Ogunlesi

Adebayo Ogunlesi was fortunate enough to be born into a respectable family. His father taught at the top university in the nation, the University of Ibadan. He was the first professor of medicine to be born in Nigeria. After attending the elite King’s College in Lagos, he continued to study philosophy, politics, and economics at Oxford. He graduated at the top of his class. He eventually moved on to Harvard to receive degrees in law and business. He excelled academically at Harvard, serving as one of the first two editors of African origin to co-edit the prestigious Harvard Law Review.

After completing his studies at Harvard, he accepted a position as a clerk for the late Thurgood Marshall, a justice of the United States Supreme Court. He worked there for three years, from 1980 to 1983. Ogunlesi was virtually the first non-American to work as a clerk at the highest court in the United States.

Before accepting a position at First Boston, an investment bank, Ogunlesi had a brief tenure as an associate at the New York law firm Cravath, Swaine & Moore in 1983.

He quickly progressed through the ranks at First Boston, moving from associate to managing director of the project finance division. He travelled extensively around developing nations, brokering high-profile agreements between financiers, governments, and businesses operating mines, oil refineries, and natural gas plants.

After acquiring First Boston in 1997, the Credit Suisse Group rebranded it as Credit Suisse First Boston (CSFB). In 2002, the new owners named Ogunlesi, who was still one of the organization’s most strategic managers and the managing director of the company’s global investment banking division, one of the most significant divisions in the organisation.

The division Ogunlesi oversaw managed almost 1,200 investment bankers and $2.8 billion in assets. He was now a member of the bank’s board of directors as well as its powerful operations committee, which had 15 members.

The elevation did provide some difficulties, though. Given that the division had lost over $1 billion the year before, Ogunlesi had to bring it back to profitability. Within the first few weeks of his leadership, he fired 50 top executives and 300 bankers in a lean, mean management style. He persuaded the remaining employees to accept wage reductions and pushed for lower operating costs. The use of limos by top bankers had to be given up in favour of taxis. But his cost-cutting strategies had a magical effect.

The bank became profitable again and saw a 25% increase in revenue within a year.

Africa in mind

Adebayo Ogunlesi manages to keep up with events in Africa despite his protracted stay in Europe and America.

In 2009, he was appointed non-executive chairman of the Africa Financing Corporation (AFC), a financial organisation created to upgrade Africa’s vital infrastructure and make investments in significant areas of the continent’s economy. He has actively promoted the continent’s economic revival. The $240 million Main One submarine fibre optic cable, which would increase telecommunications capacity in West Africa, was led by AFC. It was modelled after the International Financial Corporation (IFC), the private sector arm of the World Bank Group.

The $750 million syndicated credit facility used to build the historic Ghanaian Jubilee Oil Field, one of West Africa’s major deepwater offshore ventures in more than ten years, was also led by AFC, which also served as the continent’s representative.

Ogunlesi is leading the corporation’s effort in Nigeria to address the nation’s epileptic power supply. To assess the main problems, pinpoint the limitations, and give workable answers to the difficulties Independent Power Plants (IPPs) in the nation face, it convened a roundtable on the electricity sector in January 2011. Ogunlesi’s love for his native nation has led him to counsel many governments on economic development, strategic management, and fiscal policies. Former President Olusegun Obasanjo used him as an informal advisor. He occasionally provides advice to the current administration of the nation.

I am very proud of him: the Great Man, Mr Adebayo Ogunlesi. Grand Rising to you, sir.

He inspires me a lot.