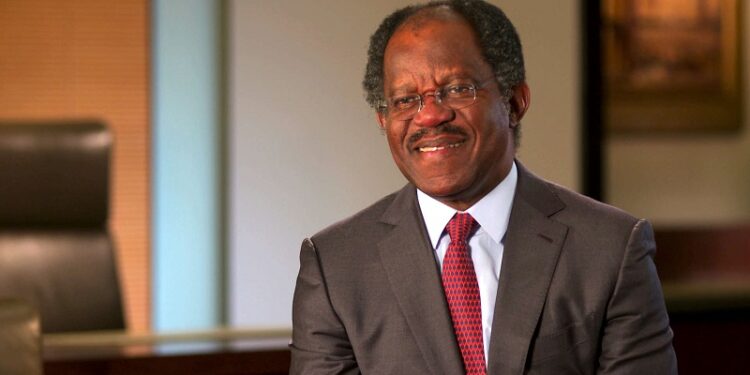

Nigerian banker and founder of Global Infrastructure Partners (GIP), Adebayo Ogunlesi, pole-vaulted into the ranks of Africa’s billionaires with an estimated net worth of $2.3 billion with the sale of his company to BlackRock Inc. at an estimated cost of $12.5 billion.

A recent update by Bloomberg reveals that the surge in Ogunlesi’s net worth, led by US billionaire Larry Fink, ended a historic agreement to acquire the infrastructure firm after the sale to BlackRock.

According to reports, the deal consists of $3 billion in cash and approximately 12 million shares of GIP’s common stock, estimated at $9.5 billion, setting the 70-year-old Nigerian among the continent’s wealthiest persons.

With a 17.5% share of GIP, Ogunlesi is now one of Africa’s top 20 billionaires. He founded BlackRock in May 2006.

Under his leadership, the company became one of the world’s largest independent infrastructure managers, boasting over $100 billion in assets.

The deal with BalckRock will reportedly close in the third quarter of this year to create a solid multi-asset-class infrastructure platform with a clientele exceeding $150 billion.

BlackRock’s acquisition of the company is a critical milestone for Ogunlesi and GIP, which diversified its portfolio into the transport sector, natural resources, and power generation.

It acquired the London City Airport in 2006, raising GIP’s journey to extraordinary levels.

BlackRock is committed to appointing Ogunlesi to its board at the next meeting after closing the deal, emphasizing the importance of his leadership and expertise.

The GIP management team, including Ogunlesi and the four founding partners, will lead the combined platform, leveraging their investment and operational proficiency.