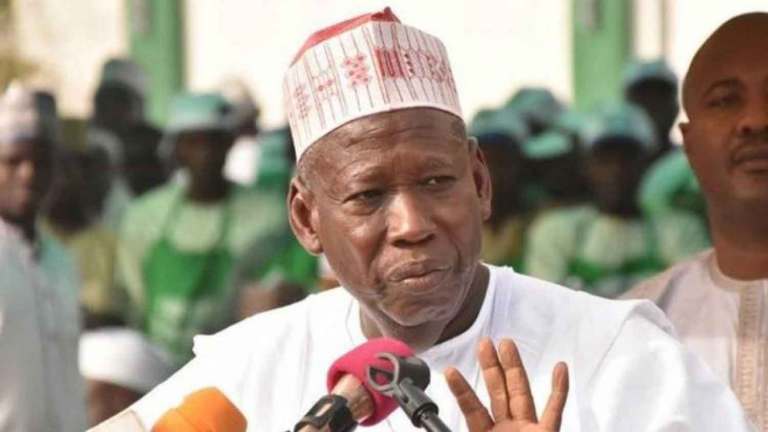

Accusing fingers are being pointed at the erstwhile Managing Director of Fidelity Bank, Nnamdi Okonkwo, who is facing allegations of discrepancies during his tenure as the Chief Executive Officer of the Nigerian bank by his successor, Nneka Onyeali-Ikpe.

REPORTERS AT LARGE recalls that the EFCC had arrested Okonkwo and some officials of Fidelity Bank for allegedly receiving $115 million from an ex-Minister of Petroleum, Diezani Alison-Madueke.

It is also on record that the EFCC had alleged that during the build-up to the 2015 presidential election, the former Fidelity Bank boss was invited by Alison-Madueke to help her handle some cash, which was later allegedly disbursed to electoral officials and groups.

The anti-graft agency had filed charges of money laundering against Alison-Madueke and Okonkwo before the inception of President Muhammadu Buhari’s administration.

It was gathered that Onyeali-Ikpe decided to beam a search on past activities of her predecessor because of his opposition to her being picked as his successor.

As Okonkwo’s moves failed, Onyeali-Ikpe allegedly decided to use her new position to ensure the swift probe of her predecessor, in order to make him respond to certain questions on issues during his time as the CEO of the bank.

Available proofs at Onyeali-Ikpe’s disposal of Okonkwo’s alleged misconducts were said to have prompted her eagerness to pay him back in his own coin.

According to insiders, politics had taken over the bank as some of its officials had remained loyal to the immediate past CEO of the bank.

Another source revealed that Okonkwo had wooed the Chairman of the Board of Directors of the bank, Ernest Ebi, to make one of his allies succeed him as the MD/CEO, instead of Onyeali-Ikpe.

In a bid to fight back, the new Fidelity Bank’s CEO proposed an investigation of her predecessor which had been promptly assented to by the new board of the bank.

The News Bearer reports another source as saying that “following a pool of information at her disposal, Onyeali-Ikpe felt compelled to probe Okonkwo’s activities.”

It was further gathered that some top officials of the bank had been leaving to avoid being probed, as not more than 300 top and middle-level personnel had been reportedly relieved of their duties.

Okonkwo’s had had several controversies and questions begging to be answered over his integrity.